The transition from working to retirement is an important stage in the life of working people. With the increase in life expectancy and progress in health, we are almost all assured of living many more years, free of the constraints of the working world.

So we should prepare ourselves as well as possible for the years that remain to be lived. Managing this transition is as much about anticipating future activities as it is about continuing to reach out to others or providing sufficient income to live well in retirement. Our 5 tips for managing the transition from working life to retirement

1. Anticipate your transition from working life to retirement

To make the most of your transition from working life to retirement, make sure you prepare for this step well in advance. You should think about and organize your activities and future lifestyle three or four years before your retirement. Stopping your professional activity does not mean staying inactive.

On the contrary, this is the period of your life when you will have plenty of time to indulge your passions, so why not take up sports or travel to countries you have always dreamed of? Anticipating your transition from active life to retirement means asking yourself the right questions: “What do I want to do?”, “What am I capable of doing?” or “What have I never dared to do until now?

2. Share your fears about retirement

The fact of having to leave the professional world, breaking with a schedule punctuated by work, and possibly losing responsibilities is experienced differently depending on the person. Some will enter their retirement period serenely and with enthusiasm, while others will not take it well or will fear finding themselves without work and colleagues overnight. It is true that the arrival of retirement is most often dealt with in more technical terms (pension, liquidation, etc.) than in human terms.

However, it is normal to approach the end of one’s working life and the transition to retirement with a certain amount of apprehension. This may be the time to approach a professional (psychologist, psychiatrist, etc.) who will allow you to talk freely and free you from your legitimate anxieties so that you can approach this new stage of life as well as possible.

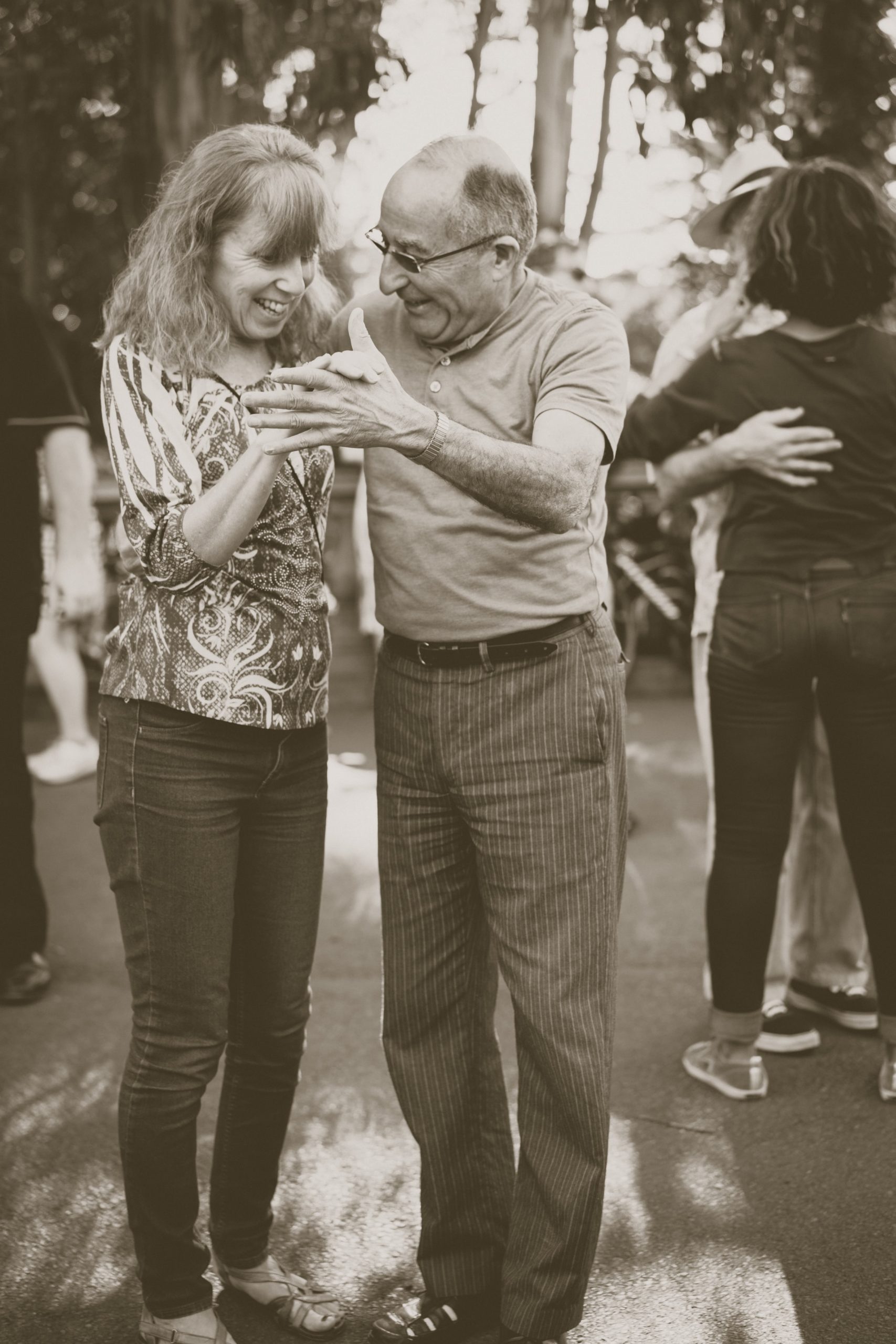

3. Dare to reach out to others

Retiring does not mean isolating yourself from society; it is not necessarily synonymous with solitude, and even quite the opposite for some people. If you don’t want to suffer from isolation, as thousands of older people unfortunately do, the passage to retirement is the ideal time to reach out to others and not cut yourself off from society. Many sports, cultural, artistic, volunteer activities, etc., are offered to seniors.

Reaching out to others can also mean traveling. Traveling in a group, for example, discovering new cultures by your own means and making nice human encounters. This may be the time for you to get involved as a volunteer in an association that has been close to your heart for a long time but for which you lacked the time during your active life.

4. Opt for a progressive retirement

Nothing obliges you to retire at 100% right away. If you are apprehensive about this transition from working life to retirement, consider taking a phased retirement. This possibility of arranging this stage of life by continuing to work part-time while receiving a part of your retirement pension is a perfect solution for those who wish to reserve a sort of “airlock” between working life and retirement. The possibility of retiring gradually is subject to certain conditions, notably the number of quarters contributed and the age.

5. Preparing financially for retirement

The question of the transition from working life to retirement often comes down to most people’s fear of isolation and loneliness. But, for many, it is also primarily a question of financial concerns. Indeed, receiving a retirement pension almost always means a drop in one’s standard of living, not to mention insurance and supplementary health care. It is therefore important to look ahead to your future resources once you retire and to consider solutions to supplement them to lead a decent life without too many changes compared to your working life.

Sound off in the comments section below and tell us what you want to read next and if you want to read more about the transition from working to retirement.